Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Loading...

Ty Everett ([email protected])

The BRC-9 specification defines a process for Simplified Payment Verification (SPV) that allows payment recipients to verify the validity of a transaction without downloading and verifying the entire blockchain. The process involves verifying the headers and proofs of a BRC-8 Transaction Envelope, ensuring that all SPV proofs link back to the genesis block and the chain with the most proof of-work, and confirming that the transaction is valid according to the rules of Bitcoin. This standard aims to facilitate fast, secure, and efficient payment processing for merchants and users.

The Bitcoin blockchain is a decentralized, distributed ledger that records every transaction on the network. However, downloading and verifying the entire blockchain can be time-consuming and resource-intensive, making it impractical for users who want to make quick, simple transactions. Simplified Payment Verification (SPV) provides a way for payment recipients to verify the validity of a transaction without the need for a full blockchain download. This protocol is essential for enabling fast and efficient payment processing, especially for small, casual transactions.

The steps for verifying the validity of a payment transaction using the BRC-9 SPV protocol are as follows:

Ensure that the received Envelope is in the correct format

Add any previously-unknown headers provided in the Envelope to the chain of headers

Ensure that all SPV proofs link back to the genesis block and the chain with the most proof of-work

The above steps ensure that the transaction is valid and secure according to the Bitcoin protocol. Merchants may take additional measures to increase security, such as subscribing to mAPI status updates and double spend notifications, verifying the identity of the sender, waiting for confirmations, or using an escrow service.

Any wallet that has access to a source of block headers is capable of verifying merkle proofs, and any computer with the resources needed to execute the Bitcoin script programs from the chain of spends is capable of verifying the chain of custody. This means that almost any modern digital computer can easily perform Simplified Payment Verification by following the steps outlined in this document.

Ty Everett ([email protected])

The BRC-46 architecture for digital assets stored within wallet baskets enables a wide range of use cases. However, it lacks support for more than a rudimentary permission system. Wallets can grant applications blanket access to basketed assets, or deny access entirely, but cannot make insightful decisions based on the specific assets stored, their output scripts, or the tokenized value they represent. To support the future development of new permission schemes covering fungible and non-fungible digital assets within wallets, we propose reserving certain basket identifiers to prevent their use by applications and ensure compatibility with future standards.

The motivation for this proposal is to future-proof the architecture by enabling the seamless integration of new permission schemes applicable to assets stored in or retrieved from wallet-managed UTXO baskets. By specifying reserved identifiers, we can ensure that new security and permission paradigms can be implemented without conflicts or unintended behavior.

To accommodate future basket permission schemes, wallets must reject any operation requests made under basket IDs beginning with p (a lowercase “p” followed by a space).

Future permission schemes must define their ID formats, as follows:

The scheme IDs cannot contain spaces.

The basket IDs must start with p , followed by the scheme ID, a space, and the rest of the basket identifier.

A basket ID such as p dollarToken xxxxx could represent a specific token type (e.g., tokenized dollars), where:

p designates an alternative permission scheme.

dollarToken identifies the permission scheme.

xxxxx forms the basket ID under the alternative scheme.

Wallets must differentiate between standard and alternative permission schemes by recognizing the p prefix followed by a distinct, space-free scheme ID. To ensure unambiguous parsing.

Upon recognizing a basket ID structured as p <scheme ID> <rest of the ID>, wallets may apply the specific rules defined by the scheme associated with the scheme ID. These rules could define:

Constraints based on specific locking scripts or script templates of UTXOs.

The conditions under which operations can be executed.

Mechanisms for allowing applications to access only a certain set number of only a specific asset type, according to the rules of some tokenization protocol, overlay service or script template.

Specific counterparty requirements and other customizable permission attributes.

To maintain clarity and prevent conflicts:

Basket IDs beginning with p must be reserved for future use.

Wallets must reject operations involving such IDs unless they explicitly support the scheme ID.

A space must immediately follow the scheme ID to separate it from other elements.

This specification allows future permission schemes to extend beyond current models (e.g. paradigms), enabling flexible and innovative wallet permissions that evolve with user and application needs.

For example, a wallet could allow access to a maximum of 10 dollars of tokenized fiat money per month within an application.

By reserving basket IDs starting with p and specifying rules for future permission schemes,this specification ensures forward compatibility and robust wallet permission functionalities. It enables seamless integration of new schemes without disrupting existing applications or introducing parsing ambiguities.

Jane Doe ([email protected])

This proposal introduces an absurd, humorously impractical method for controlling embedded Bitcoin wallets in web-based applications using the power of bananas.

The Abstract section should concisely describe your proposal at a high-level.

The purpose of this proposal is to provide a lighthearted example of how to create a standard that adheres to the BRC format while sparking laughter and enjoyment among readers.

The Motivation section should let people know the context for your proposal, and why it was written.

Wallets must be embedded within a real banana fruit, using cutting-edge bio-organic engineering techniques.

Web-based applications must communicate with the banana-embedded wallet using a Banana Communication Protocol (BCP) involving a series of gentle squeezes.

Squeezes will be translated into binary code, with a short squeeze representing '0' and a long squeeze representing '1'.

The Specification section of your proposal should stipulate all information needed to implement the standard, and make up the bulk of the document. Generally, people should be able to create a compatible implementation with only the specification.

Wallet developers must carefully select the finest bananas available, ensuring they are both ripe and durable.

A custom JavaScript library, BananaJS, must be developed for web-based applications to interact with the wallet using the BCP.

Wallet applications must include a sophisticated squeeze detection system to ensure accurate communication.

Wallet developers must implement a "peel screech" alarm system for added security.

The Implementations section should contain information about places where the standard is implemented, or examples of its implementation.

1: Doe, J. (2023). Banana-Powered Bitcoin Wallet Control Protocol: A Humorous Guide. Bananaverse Press.

2: Smith, T. (2022). The Art of Banana Communication (Volume IV): Avoiding Single Points of Failure in Banana Communications. FruitTech Publishing.

The References section should contain any footnotes used throughout the document.

Ty Everett ([email protected])

This standard provides a script template that enables data-rich tokens on the Bitcoin SV blockchain, while still allowing for the representation of transfers of ownership. By pushing arbitrary data into stack elements and subsequently dropping them, followed by adding a simple P2PK lock, this script template allows for the creation of tokens with metadata, which can be exchanged on overlay networks. This standard facilitates improved scalability by representing tokens as UTXOs, which can be easily modeled and used in graph structures.

The need for this standard arises from the growing demand for data-rich tokens in the ecosystem. Current tokenization methods such as OP_RETURN lack output spendability and representation of ownership, making them unsuitable for many use cases. This standard allows developers to push arbitrary data onto the stack, while still enabling ownership transfer with a simple P2PK lock. This feature facilitates improved scalability by representing tokens as UTXOs, which can be more easily modeled and used in graph structures. Use-cases for these tokens are numerous, ranging from deeds to cars to metadata-rich digital assets. While it does not purport to solve every use-case, such as those requiring complicated spending constraints, this standard is a crucial step in the direction of enabling more sophisticated data-rich tokenization on the Bitcoin network.

We specify that output scripts must first push data onto the stack, followed by using OP_DROP and OP_2DROP to drop the pushed data. Next, the public key of the owner of the token is pushed, followed by OP_CHECKSIG. The unlocking script comprises a digital signature from the owner's public key, which facilitates spending of the token. Each token output must contain at least one satoshi. This standard does not define specific forms of tokens or specific requirements for higher-order overlays with validation rules for their transfer and conveyance.

The following is an example output script for a token as defined by this standard:

This script template has been implemented within the .

This script template enables tokenization on the Bitcoin SV blockchain by providing a simple and effective way to create data-rich tokens that are still spendable and locked to their owners. This is achieved by pushing arbitrary data onto the stack, dropping it with OP_DROP or OP_2DROP, and then adding a simple P2PK lock with a public key and OP_CHECKSIG.

When a token is created using this template, it is represented as an unspent transaction output (UTXO) that contains at least one satoshi. This UTXO can then be transferred to another user by creating a transaction that spends the UTXO and includes the owner's digital signature in the unlocking script.

The template facilitates tokenization by allowing developers to specify any number of stack elements with arbitrary data, representing tokens on overlays, while still enabling spending and ownership with simple locks. This makes it easier to model and use tokens in graph structures, improving scalability and enabling a wide range of use-cases.

Ty Everett ([email protected])

We propose a peer-to-peer token exchange protocol under which two parties can securely exchange digital tokens (assets) within Bitcoin SV's BRC-22 UTXO-based Overlay Networks.

Ty Everett ([email protected])

This document serves to clarify that there is no BRC-20 standard for tokenization on Bitcoin SV. While Ethereum has the ERC-20 standard for account-based tokens, there is no equivalent for UTXO-based systems such as Bitcoin SV. In order to avoid confusion and prevent people from conflating ERC-20 with BRC-20, it is necessary to clarify that BRC-20 does not exist on Bitcoin SV. Instead, proposals for tokenization should be judged on their own merits. Being associated with ERC-20 will not make any specific tokenization proposal better, and there is not a desire to confer greater legitimacy to one proposal or another.

Ty Everett ([email protected])

In BRC-22 overlay networks, various forms of state tracking for UTXOs can be incorporated. Servers can track UTXOs according to many criteria, enabling many use-cases. There is no fundamental requirement that a server relies on strictly on-chain data for these operations. In this document, we explore the use of off-chain secrets and offset values, enabling private overlay networks to be tracked among transactions that, on the surface, appear only to be normal P2PKH spends. Various models will be explored, from overlay network secrets to data linkages revealed off-chain. All of these methodologies rely on the isomorphic properties of the curve, enabling the owners of the UTXOs to retain spendability rights even when the P2PKH outputs also contain other information stored within offsets from the root key. This information is used to make on-chain record of private, off-chain data, which can later be revealed.

The motivation behind this protocol is the need for an efficient and secure mechanism to exchange different types of tokenized assets on top of overlay networks between two parties in the BSV ecosystem.

The protocol is initiated when two parties, Alice and Bob, desire to conduct an asset exchange. It assumes that both parties are online. We specify this protocol conceptually, by example:

Offer Initiation: Alice wants to sell 5 apples for 3 USD. She creates a new transaction moving her 5 apples into a new output. This output includes her exchange request, peer-to-peer contact information (such as BRC-33), and the asset ID for the asset she would like to exchange, reflected in a new transaction on the overlay network.

Revocation by the Initiator: If Alice decides to cancel her proposition, she can spend the offer output and move her apples back, retracting the offer.

Offer Acceptance: Bob is looking to purchase 5 apples for his 3 USD. He sees Alice's offer, verifying her offered UTXO(s) are registered on the overlay. Bob creates a new transaction, conditionally signing his USD over to Alice using SIGHASH_SINGLE. He ensures the signature is only valid over all the inputs from both Alice and Bob. The single output which he signs pays himself the 5 apples from Alice's inputs.

Offer Presentation: Bob contacts Alice, identifies himself and shares the transaction and signature with her.

Verification: Alice verifies the information and conducts due diligence to confirm Bob's outpoints on the overlay network. She verifies the signature and the validity of the transaction. If she decides not to proceed, she can simply do nothing or send Bob a rejection message.

Transaction Settlement: Alice responds by signing her inputs with a SIGHASH_ALL signature, spending her inputs, and adding an output that pays her Bob's 3 USD. She adds her signature to the transaction, and broadcasts it to Bob and the overlay network. Once her transaction reaches the overlay network, Alice now possesses Bob's 3 USD and Bob is the owner of Alice's 5 apples.

This Token Exchange Protocol can be implemented on any UTXO-based overlay network adhering to BRC-59, BRC-45, BRC-22 and BRC-24. This protocol has security built-in, stipulating both SIGHASH type usage and broadcasting and topical membership verification methods.

In general, overlay network recovery mechanisms for uncooperative participant handling (non-registration or improper broadcast of transactions) need to be defined as part of future specifications. Further tooling and guidance for developers would expand adoption.

As the Bitcoin ecosystem continues to mature and grow, there is an increasing desire to create standards for tokenization. However, it is important to recognize that the architecture of Bitcoin is fundamentally different from that of Ethereum. While Ethereum is an account-based system, Bitcoin is a UTXO-based system. This means that there is no direct equivalent for something like ERC-20, which defines account-based tokens on top of Ethereum. The goal of this document is to prevent unnecessary confusion.

UTXO-based systems are fundamentally different from account-based systems. While Ethereum has the ERC-20 standard for account-based tokens, there is no equivalent for UTXO-based systems such as Bitcoin. Tokenization will necessarily require a different approach, one which should not be conflated.

Avoiding confusion is essential. If there were a BRC-20 standard for Bitcoin SV, it would likely be confused with the ERC-20 standard on Ethereum. This could lead to a lack of clarity and understanding among developers and users, which could ultimately harm the growth and adoption of tokenization in both Bitcoin and Ethereum.

Proposals for tokenization should be judged on their own merits. The absence of a BRC-20 standard on Bitcoin SV does not mean that tokenization is not possible. Instead, proposals for tokenization should be evaluated based on their own technical merits and practical considerations. A proposal called BRC-20 will not be better on account of its name.

In summary, there is no BRC-20 standard for tokenization on Bitcoin SV. While there may be a desire to create such a standard, it is important to recognize that the architecture of Bitcoin is fundamentally different from that of Ethereum. Instead of trying to emulate the ERC-20 standard, proposals for tokenization should be evaluated based on their own technical merits and practical considerations. This approach will ultimately lead to a more mature and professional ecosystem for tokenization.

As with any other BRC, tokenization proposals will be assigned sequential numbering.

In the first use-case, a user sends a transaction to an overlay. The transaction pays some Bitcoins to a P2PKH address. The user reveals the public key to the overlay node at time of transaction submision. The user has computed the pblic key used as follows:

Take off-chain data (d) and hash it to get h

Add the hash to the actual recipient key to obtain the final public key

Now the user can also reveal to the overlay node the value for d which produced h, and can identify the party who is receiving it.

Ensure that all specified minerID public keys have endorsed all mAPI responses

Ensure that, if only confirmed inputs were allowed, every specified input transaction is directly proven with an SPV proof rather than relying on a chain of mAPI responses

Ensure that the transaction is valid according to the rules of Bitcoin (sum of input amounts is greater than or equal to the sum of output amounts)

Ensure that the lock time of the transaction is as requested in the invoice

Ensure that, if the lock time is in the future, all sequence numbers are UINT_MAX, unless you are working with an application that supports continuously-updating payment channel transactions and expect to get another updated transaction later

Ensure that evaluating the locking scripts from the input transactions and then the unlocking scripts provided in each input is successful, thus ensuring that all inputs were properly spent

Ensure that the transaction was properly signed

Ensure that the transaction contains the output scripts and amounts that were requested in the invoice

Ensure that the transaction pays a sufficient fee according to the rules of the fee model you are using

Wallets will be recharged by leaving them in direct sunlight for a minimum of 2 hours per day.

The protocol must support a minimum of 2 bananas connected simultaneously to avoid a single point of failure2.

Web-based applications must visually display the connection and energy status of each banana wallet.

To avoid ambiguity in referring to the TSC Merkle Proof Standardized Format, it is important to have a specific identifier. The use of BRC-10 as a reference point allows for clear and unambiguous communication among developers and the community. The BRC-10 designation is similar to other proposals, such as BRC-32, which are also referenced by their BRC numbers.

You can read the TSC standard on the website.

As with any other BRC, feel free to open issues in the BRC repository that discuss extensions of BRC-10.

Ty Everett ([email protected])

This document proposes a solution for tracking transaction histories within UTXO-based overlay networks by extending the BRC-22 standard to include transaction inputs and the BRC-24 standard's query responses to include such data in extended BRC-36 input envelopes. By associating previous transaction inputs with topic-specific UTXOs and facilitating history traversal, it allows network participants to access a more complete record of UTXO histories. This standard outlines the parameters and steps needed to capture, maintain, and access historical transactional data in overlay networks.

BRC-22 successfully enables the tracking and synchronization of UTXOs across various topics in overlay networks, yet it does not accommodate the preservation of UTXO histories which can hold valuable network data. Transaction histories are key to understanding the full lifecycle of UTXOs, acting as a crucial component for certain applications in areas like network analysis and auditability. The absence of a history tracking standard leads to information gaps, preventing a comprehensive understanding of network state changes. This document presents a solution to this problem by providing a clear and standardized mechanism for maintaining and accessing transaction histories in UTXO-based overlay networks.

We introduce extensions to the BRC-22 and BRC-24 standards to encapsulate the input history of network transactions. Topic managers in BRC-22 can now prescribe which transaction inputs should be conserved and linked with the admitted transaction outputs, designating inputs that are pertinent for tracking. The BRC-24 standard, meanwhile, is adjusted to support the retrieval of past renditions of UTXOs.

Topic managers in overlay networks now perform the following additional steps:

Verify the inputs from the transaction tagged with their topic labels to determine their relevance.

Provide a return value back to the Confederacy node directing it to retain these relevant transaction inputs, so that the node can maintain them alongside admitted transaction outputs for the specified topic.

Relative location metadata and other associated data should be stored by the Confederacy node along with these inputs, enabling efficient topic-specific historical data retrieval.

The lookup services specified under BRC-24 can now:

Accept queries for the previous renditions of specific UTXOs (formats for these queries depend on the specific lookup service).

Assemble and return a responsive list comprising of the series of transactions that involve the queried UTXOs along their states across the network's history.

Extend the BRC-36 envelope return format, including transactions as inputs when they contribute to the history of the queried UTXOs.

Developers should adapt their existing BRC-22 based systems to collect and preserve pertinent transaction inputs when admitting new transaction outputs. Lookup services following the BRC-24 standard must be updated to handle queries for prior renditions of UTXOs and effectively traverse transactional histories, extending their BRC-36 envelope returns to incorporate key transaction input data for the queried UTXOs. By adhering to the changes specified in this document, network participants can ensure interoperability, efficient data access and complete historical tracking of UTXOs across overlay networks.

Ty Everett ([email protected])

Currently, there are only HTTPS URLs within SHIP and SLAP advertisements

This https: scheme indicates that, according to pre-defined rules (like headers and the /submit or /lookup paths), submission or lookups are facilitated over the HTTPS protocol.

However, sometimes we want to do things like:

Authenticate users before accepting transactions or facilitating lookup

Charge a payment for transaction submission, or pay the sender if a transaction is accepted

Charge a payment for lookup queries

Submit private or off-chain values alongside a transaction

Submit non-final transactions that deal with interim states

Facilitate real-time lookups with WebSocket or based on live / non-final transactions

Advertise certain IPv6 capabilities and bridges

Advertise non-HTTPS or non-internet communications systems like radio / JS8 Call

In these scenarios, other schemes can be used within the "protocol" portion of the URL.

For example, current SHIP/SLAP only contemplates URL schemes like https://example.com.

However, a new URL might be something like:

SHIP https+bsvauth+smf://example.com (HTTPS with BSV Auth and Service Monetization Framework enabled)

SHIP https+bsvauth+scrypt-offchain://example.com (HTTPS with BSV Auth and sCrypt off-chain values for transaction submission)

SHIP https+rtt://example.com (HTTPS with real-time transacting support, e.g. non-finals accepted)

SLAP wss://example.com (real-time event-listening live web-socket lookup response streaming)

SLAP js8c+bsvauth+smf:?lat=40&long=130&freq=40meters&radius=1000miles (lookup is advertised using JS8 Call protocol at a given set of GPS coordinates, a given frequency and radius, with BSV Auth and Service Monetization Framework enabled.

These new SHIP and SLAP schemes allow for the advertisement of new Overlay Services that have more advanced capabilities, including real-time updates from lookup services, non-final transaction submission, mutual authentication, payment, off-chain / private value submission, non-HTTP transport mechanisms, and much more.

Compared to plain HTTPS, they make a significant improvement. Facilitators for each of these custom "protocol" fields in the advertised SHIP/SLAP URLs can be implemented into standard libraries, the associated lookup services can be updated to facilitate querying by them, and new default SLAP trackers can be added so that users are able to stay connected in more ways than one.

<arbitrary data> <arbitrary data> <arbitrary data> OP_DROP OP_2DROP <public key> OP_CHECKSIGCertain checks that are unique to each implementation, such as detecting encoding errors or malformed transactions, are not covered here. Although these checks are essential, they vary according to the implementation and are not included in the definitive list presented below.

Checks made on receipt of a transaction from a counterparty:

Script evaluation of each unlocking script results in TRUE.

The sum of the satoshis-in must be greater than the sum of the satoshis-out.

Each input must be associated with a Merkle path to a block.

nLocktime, and nSequence of each input are set to the expected values.

Often this is referred to as "check the signatures" which is indeed usually the case but it is possible to have transactions which do not require signatures so for the sake of technical exactitude - running script evaluation is really what is happening here. The interpretation requires that each input unlocking script is concatenated with the previous locking script and the interpreter runs given that input. The result should be a truthy value left on the stack after execution, otherwise the predicate has failed and the utxo has not been unlocked.

Each input is a pointer to a previous output, each output has a satoshi value. Therefore to calculate the input satoshis we must have details of the previous transactions from which we are spending utxos. We use this information to determine the fees paid by the transaction. We compare these fees with the size of the Tx in bytes to arrive at a rate: sats/byte. The acceptable rate is well known, various services publish this information. At the time of publishing this rate is equivalent to 1 satoshi for a standard transaction, therefore the check could simply be:

If all inputs come from Transactions which are mined in a block, then the associated Merkle path is one which leads that txid to a Merkle root. If some inputs are not in a block then we must include previous transaction data, and follow the history of all inputs until we arrive at a point where all inputs are associated with previous inputs which appear in a mined block. Various formats will handle this differently, but the universal rule is that SPV requires that we prove that all inputs come from legitimate transactions.

In a long chain of transactions conducted while not connected to the internet, each new transaction is appended to the end of the SPV data such that all prior transaction ancestry is propagated to all counterparties, until they are broadcasted. So we would expect large SPV data payloads only when many transactions happen offline, which in today's age will be extremely rare.

The nLocktime default is 00000000, and nSequence default is FFFFFFFF. If these values are not default then there is a naunced condition to the transaction which is explained here.

Ty Everett ([email protected])

We define a mechanism by which BRC-1 applications can denote UTXOs to be unlocked and redeemed by wallets as part of new Bitcoin transactions. We extend the message format defined by BRC-1 with information about the inputs requested by the application, including all information needed for a wallet to check the veracity of any inputs being redeemed.

defines a mechanism for an application to request the creation of a Bitcoin transaction by a wallet, but it is incomplete without a way for applications to consume and use tokens that previously existed. Allowing applications to unlock and redeem inputs as part of their transactions also facilitates their ability to update, extend or delete assets that are tokenized within Bitcoin UTXOs.

We extend the Transaction Creation Request message with an additional field, the inputs field. This is an object whose keys are the TXIDs of transactions that contain outputs which are to be spent as part of this transaction, and whose values comprise extended transaction envelopes.

In addition to the normal envelope fields, we specify that these input envelopes contain an additional field called outputsToRedeem, which is an array of objects. Each of the objects comprises an output from the subject transaction that is to be redeemed and used as input to the transaction being requested by the application.

We specify that each of the objects in the array contains index and unlockingScript. The index value is an integer that denotes which output to redeem from the transaction, and the unlockingScript comprises a hex-formatted input script.

We further specify that each of the elements in each of the outputsToRedeem arrays may contain an additional spendingDescription string that describes the redemption of the tokens being used.

Here is an example of a Transaction Creation Request object that contains an input:

This functionality has been implemented as part of the , in the createAction function.

Ty Everett ([email protected])

BRC-65 extends the functionality of BRC-56 by introducing the ability to label Bitcoin transactions when they are created using the BRC-1 Transaction Creation Request. This extension allows applications to organize and categorize transactions for different purposes. BRC-65 also introduces the capability to list labeled transactions, providing applications with an easy way to retrieve specific sets of transactions based on their labels. This standardization improves interoperability between wallets and applications and enhances the user experience by enabling the display of transaction lists relevant to specific categories or actions.

The motivation behind BRC-65 is to enhance the functionality of the Bitcoin wallet messaging layer defined in BRC-56 by introducing the ability to label transactions. This functionality allows applications to categorize and organize transactions based on specific criteria. By labeling transactions, applications can easily retrieve and display transaction lists that are relevant to specific actions or categories. This simplifies the user experience and enables users to quickly find, review, and analyze specific sets of transactions.

By defining a standard mechanism for labeling transactions and listing labeled transactions, BRC-65 promotes interoperability between wallets and applications. With this standardization, applications can expect consistent behavior across different wallets, making it easier for developers to create Bitcoin-powered applications without having to build custom wallet functionality. Furthermore, users can switch between wallets seamlessly without losing access to their labeled transactions.

BRC-65 extends the functionality of BRC-56 by introducing the concept of transaction labels and the ability to list labeled transactions. This extension adds two new features to the wallet-to-application messaging layer: labeling transactions at the point of creation and retrieving labeled transactions.

The labels field is introduced as an optional parameter next to the outputs array and description of the BRC-1 Transaction Creation Request in BRC-56. This field allows applications to label transactions. Each label must be no longer than 300 characters and can only contain letters, numbers, and underscores.

The updated Transaction Creation Request with the labels field is as follows:

In this example, the application is creating a transaction with the labels "payment" and "personal". These labels can be used to categorize and organize the transaction in a way that is meaningful to the application.

BRC-65 introduces the listActions message (the Actions List Request) to retrieve a list of Bitcoin transactions based on their labels. The Actions List Request message takes the following parameters:

The Actions List Request message retrieves Bitcoin transactions that have been labeled with the specified label. The skip parameter allows applications to retrieve a subset of transactions by skipping a certain number of transactions from the beginning of the list. The limit parameter defines the maximum number of transactions to return. If skip and limit are not provided, the request will return all transactions with the specified label.

The Actions List Response comprises an array of BRC-8 Transaction Envelopes as defined in BRC-56, representing the labeled transactions, along with a totalActions field denoting the total number of transactions with the specified label.

An example Actions List Request message with the label "payment" and a limit of 10 transactions is as follows:

The corresponding Actions List Response would contain an array of BRC-8 Transaction Envelopes as well as the totalActions field:

In this example, the actions list response includes an array of BRC-8 Transaction Envelopes representing the labeled transactions with the label "payment". The totalActions field indicates that there are a total of 42 transactions with the "payment" label.

Implementations of this specification will need to extend the existing wallet software in order to support the labeling of transactions and the listing of labeled transactions. Wallets will need to ensure that they can create transactions with labeled outputs and store the labels for future retrieval. Applications will need to handle the labeling of transactions and make use of the Actions List Request to retrieve labeled transactions.

Some existing implementations of BRC-56 may already support the labeling and listing of transactions, while others may need to update their software to include this additional functionality. The Babbage MetaNet Client, for example, has already implemented the Transaction Labels and List Actions functionality.

Ty Everett ([email protected])

This document proposes an examination of Unspent Transaction Outputs (UTXOs) as the central framework of tokenization in Bitcoin, justifying their usage based on their inherent simplicity, efficiency, and secure transfer processes. Through UTXOs, Bitcoin allows the delineation of rules governing the transfer of valuable tokens via scripting. In contrast to alternative tokenization proposals, UTXOs render the need for comprehensive, trusted indexing and chain scanning systems obsolete. Instead, transaction parties require only to validate transactions pertinent to them, employing miners to mitigate double-spend attempts, thus achieving tokenization of assets at scale.

Tokenization, in the realm of digital assets, represents the process of substituting valuable, real-world assets with digital tokens on a blockchain. Within the context of Bitcoin, tokenization predominantly revolves around Unspent Transaction Outputs (UTXOs).

Unspent Transaction Outputs (UTXOs) are remnants of Bitcoin transactions yet to be spent or used as inputs for newer transactions. Each UTXO in Bitcoin can be seen as a distinct token. Unlike other tokenization methods, UTXOs are directly transferred from sender to recipient, the legitimacy of which can be independently verified, thus significantly reducing computational and time complexities.

Scripts in Bitcoin define the conditions under which UTXOs can be spent. These conditions form the essence of token transfer rules, ensuring secure transactions of digital tokens.

Simplified Payment Verification (SPV) is a method used in Bitcoin for lightweight clients to verify transactions without requiring the entire blockchain's download. The process for SPV enables recipients to verify transfers quickly.

UTXOs offer a unique advantage as the foundational unit of tokenization in Bitcoin due to their inherent characteristics and the robustness they bring to the transaction system:

Decentralization and Trust Minimization: With UTXOs, parties need only to validate transactions that concern them, eliminating the necessity for a trusted intermediary to index and scan every transaction on the blockchain. This process enhances the decentralized nature of Bitcoin and minimizes trust requirements.

Scalability: By treating UTXOs as the base unit of tokenization, we can facilitate efficient asset tokenization at scale. With direct transfers, the UTXO model bypasses complex indexing systems, thus reducing computational overhead and increasing transaction speed.

Double-Spend Protection: Miners play an integral role in UTXO transactions by preventing double-spending. As each UTXO can only be spent once, miners verify and confirm that no UTXO is duplicated or spent twice, preserving the security of the blockchain.

In summary, the UTXO model provides an efficient and scalable framework for tokenization in Bitcoin, while upholding the principles of decentralization and trust minimization. Its distinctive attributes such as direct transfer, double-spend prevention, and simplified verification lend themselves to a secure and streamlined tokenization process, validating the assertion that UTXOs are the fundamental unit of tokenization in Bitcoin.

The OP_FALSE OP_RETURN script template is a method for storing data on the Bitcoin SV blockchain. It creates a non-spendable output and appends the desired data to the end of the script for storage. This standard aims to define the rules and best practices for using this script template.

The low transaction fees and high capacity of the Bitcoin SV network make it an attractive option for storing data on the blockchain. The OP_FALSE OP_RETURN script template is a widely used method for achieving this goal due to its simplicity and ease-of-use.

To use the OP_FALSE OP_RETURN script template, an output must be included in a Bitcoin transaction with a locking script comprising OP_FALSE followed by OP_RETURN, followed by the data to store in the script. The data can be pushed into one or multiple stack elements after the OP_RETURN opcode.

For example:

Several implementations and protocols make use of the OP_RETURN script template, including the and .

The main limitation of using OP_FALSE OP_RETURN is the non-spendability of these outputs and their ability to be pruned by miners. They are records rather than tokens. Artefacts predominantly as a proof of existence of data at a certain time - timestamped by the Bitcoin system as a hash with a merkleproof to a block, even if miners themselves prune the data.

Ty Everett ([email protected])

This BRC extends by adding the ability to remove specific outputs from a basket and delete digital certificates that are no longer required. Applications can request that a wallet remove outputs from a basket by providing the transaction ID (txid) and the output index (vout

Tone Engel ([email protected])

The BEEF serialization format (as defined in ) is essentially two things:

An array of mined transaction proof validation data (BUMPS )

Ty Everett ([email protected])

Bitcoin uses scripts to control transactions, and three of the most common ways to represent a script are binary, hexadecimal, and ASM. This standard aims to provide a detailed description of these formats to facilitate their use in BSV transactions.

Ty Everett ([email protected])

This document describes the Universal Hash Resolution Protocol (UHRP), a standard framework for content availability advertisement implemented with a UTXO-based overlay network. UHRP enables content hosts to advertise the availability of a particular file by creating a UTXO-based advertisement token, which is then submitted to the UHRP overlay and tracked by overlay network nodes. UHRP provides resilience to single points of failure and ensures content accessibility even if one host is offline, because multiple entities can be paid by content providers to keep content available.

Deggen ([email protected])

We specify a paymail capability extension which supports the passing of BEEF Transactions between hosts. The procedure for service discovery and requesting outputs is not detailed, rather this proposal contains only a recommendation to replace hex data with hex data.

Ty Everett ([email protected])

This document proposes standardized naming conventions for topic managers in BRC-22 and lookup services in BRC-24 to ensure clarity, interoperability, and uniformity across different implementations. The goal is to provide consistent and easily understandable names that facilitate efficient communication and integration between overlay network nodes and services within the BSV ecosystem.

This BRC standard outlines the implementation and use of bare multi-signature (multi-sig) transaction output scripts within the Bitcoin SV digital asset ecosystem. By employing OP_MULTISIG opcodes directly, this approach offers simplicity and ease of implementation while providing enhanced security and access control for transactions. However, it also highlights the trade-offs in terms of privacy for participants. The standard comprises a motivation section, detailing the benefits of bare multi-sig transactions; a specification section, explaining the structure of these transactions; an example section, demonstrating a 2-of-3 multi-signature locking and unlocking script; and a "how it works" section, delving into the fundamentals of bare multi-sig transactions and their role in the Bitcoin SV ecosystem.

Ty Everett ([email protected])

In one view of Bitcoin, only spendable output scripts with satoshis attached constitute valid Bitcoin tokens, because Bitcoin tokens are UTXOs. Since traditional scripts are not compatible with this view, we propose a methodology for creating OP_RETURN scripts that are spendable and contain satoshis. This provides a way for software to automatically convert non-compliant OP_RETURNs into proper Bitcoin tokens while encouraging developers to consider the spendability constraints that govern their tokens.

Ty Everett ([email protected])

This document builds upon the insights of and proposes a scalable, efficient IPv6 multicast protocol specifically designed for the broadcast of blockchain transactions and the delivery of transaction status updates, such as merkle proofs and double-spend attempt notifications. Recognizing the limitations of existing IPv6 multicast protocols, including Multicast Listener Discovery (MLD), this protocol addresses the needs for massive scalability, efficient data delivery, and economic sustainability required by modern blockchain networks. This protocol employs a layered approach using MLDv2 at the edges, multicast Border Gateway Protocol (mBGP) at the core, and introduces an intermediate aggregation/summarization layer to ensure global scalability and efficiency.

This document is intended for network engineers and architects familiar with IPv6 and multicast technologies but may not have extensive knowledge of blockchain technology. The technical details provided aim to bridge the knowledge gap and foster understanding of the specific network demands and solutions in blockchain operations.

Ty Everett ([email protected])

We define a set of reserved protocol namespaces that can be employed by clients utilizing the invoice numbering scheme to be set aside for administrative and internal use by the client software itself. This enables client software to manage its own internal state without the risk that application software will utilize the same internal protocols.

sumInputAmounts > sumOutputAmountsBitcoin transactions are the mechanism for transferring custody of bitcoin tokens from one party to another. It is crucial to have a clear and unambiguous specification for their format. The raw hex format is widely-used and understanding its structure is important for developers and other stakeholders in the Bitcoin ecosystem.

A Bitcoin transaction consists of a version number, a locktime value, a list of inputs, and a list of outputs. The format for a raw hex Bitcoin transaction is as follows:

Version: 4-byte integer (little-endian)

Input Count: variable-length integer

Inputs: a list of input objects, where each input object has the following fields:

Previous Transaction Hash: 32-byte hash (little-endian)

Previous Transaction Output Index: 4-byte integer (little-endian)

Script Length: variable-length integer

Unlocking Script: variable-length script

Sequence Number: 4-byte integer (little-endian)

Output Count: variable-length integer

Outputs: a list of output objects, where each output object has the following fields:

Value: 8-byte integer (little-endian)

Script Length: variable-length integer

Locking Script: variable-length script

Locktime: 4-byte integer (little-endian)

The variable-length integer is a compact representation of an integer value. The first byte of the integer determines the format of the integer:

If the first byte is less than 0xfd, then the integer is that byte value.

If the first byte is 0xfd, then the integer is the next two bytes in little-endian format.

If the first byte is 0xfe, then the integer is the next four bytes in little-endian format.

If the first byte is 0xff, then the integer is the next eight bytes in little-endian format.

The script fields in the input and output objects are interpreted as bytecode for a Bitcoin Script, which is a stack-based language used to define spending conditions for bitcoin.

The transaction hash (referred to as the "TXID") is calculated by taking the double-SHA256 hash of the entire transaction. This hash is used as a unique identifier for the transaction on the Bitcoin network.

Currently, there is no unified naming convention for topic managers and lookup services utilized in BRC-22 and BRC-24 standards. This absence can lead to confusion and errors in integration.

Network services that deal with the same transactions and protocols should negotiate to agree upon a common name for their topic managers and lookup services. This ensures resiliency, in that network users are able to access the same services at known locations across nodes, even if one node in an overlay network goes down. It also aids node operators in synchronizing relevant transactions with one another.

Consistency: Names should be consistent across different implementations to avoid ambiguity.

Clarity: Names should be clear and descriptive enough for developers to understand their purpose.

Length: While names should be descriptive, they should also be concise to ensure ease of use in configurations and codebases.

Only lower-case letters and underscores.

Must not start or end with an underscore.

No consecutive underscores.

No longer than 50 characters.

Prefix: Use the prefix tm_ to indicate a topic manager.

Topic Identifier: Follow the prefix with a short descriptor of the topic.

Example:

tm_uhrp_files

tm_tempo_songs

Prefix: Use the prefix ls_ to denote a lookup service.

Service Identifier: Follow the prefix with a brief descriptor of the lookup service functionality.

Example:

ls_uhrp_files

ls_tempo_songs_search

Each overlay network node and service provider must update their naming conventions to comply with the standardized guidelines described in this document. This update involves renaming existing topic managers and lookup services accordingly and ensuring that new implementations follow these standardized conventions.

By standardizing naming conventions for topic managers and lookup services, we can significantly enhance the clarity, consistency, and interoperability of overlay networks on the BSV blockchain.

Simplified Verification: The BRC-9 process for SPV enables easy verification of transfers without needing the full blockchain data. In UTXO-based transactions, the recipient can independently validate the transaction, making it efficient and user-friendly.

In the digital world, consumers often require access to specific content without regard for the hosting source. Content providers, on the other hand, have a vested interest in maintaining wide availability of their offerings, even during host outages. Existing systems, however, do not provide a standardized and robust means of connecting users to their required files.

UHRP addresses this by enabling multiple content hosts to advertise the availability of content using UTXOs. Users can seek the content based on its hash, ensuring they connect to the files they need via an overlay network that is resilient to single points of failure. Content providers wishing to ensure consistent availability can pay multiple hosts, so that content remains available even if one host goes down.

This new paradigm not only streamlines content availability but also enables new hosts to build reputation by demonstrating opportunity cost (for example, by paying higher than normal transaction fees to miners on hosting commitments). Over time, service providers and applications can build a trusted list of UHRP hosts, thereby improving the overall reliability and trustworthiness of the content hosting ecosystem.

A UHRP advertisement token comprises a Bitcoin UTXO with a locking script containing the following components:

<public key>: This is the public key associated with the host that is making the advertisement.

OP_CHECKSIG: Ensures that if the token becomes spent, a signature was made using the host's private key.

Protocol prefix: A protocol prefix pushed onto the stack, with a value of 1UHRPYnMHPuQ5Tgb3AF8JXqwKkmZVy5hG.

<address>: The base58 version of the address corresponding to the <public key>.

<hash>: The next 32 bytes are the SHA-256 hash of the content being advertised.

<url>: The HTTPS URL where the host is advertising that the content is available for download.

<expiryTime>: A UTF-8 encoded version of a decimal integer representing the Unix timestamp of the advertisement expiry.

<contentLength>: A UTF-8 encoded version of a decimal integer representing the byte length of the content.

<signature>: A digital signature over the concatenated fields fields from the host's <public key>.

Upon creation and submission of an advertisement to a BRC-22 overlay network node for the UHRP topic, the node will track the UTXO and facilitate its lookup via a BRC-24 lookup service with the provider name UHRP. If the token ever becomes spent, the advertisement is canceled. The spending transaction may contain more information justifying the host's revocation (shch as a DMCA notice), but any such stipulation is beyond the scope of this initial document, and left for others to specify later.

Tools such as NanoSeek (for downloading) and NanoStore-Publisher (for uploading to a NanoStore provider) have been created by the Babbage team. To implement the serialization format, the uhrp-url tool can be used.

Questions about this initial draft specification should be directed to the author.

With the increasing volume of transactions in blockchain networks and the need for rapid propagation, traditional methods of transaction broadcast and update delivery are becoming inadequate. MLD, as noted in BRC-80, provides mechanisms for IPv6 hosts to report interest in multicast groups, but does not scale to the needs of global blockchain operations, which involve potentially trillions of multicast groups.

MLDv2 allows IPv6 nodes to report not only their interest in specific multicast groups but also to specify interest in blocks of addresses. This capability is crucial for managing the high volume of multicast groups involved in blockchain networks.

Local Router Management: Routers at the network edge use MLDv2 to manage local subscriptions efficiently, dynamically handling group memberships as user interests change.

mBGP manages the exchange of multicast routing information between autonomous systems, crucial for the global delivery of multicast traffic.

Global Traffic Routing: mBGP ensures that multicast traffic is routed efficiently across different ISPs and backbone networks, based on aggregated routing information that represents the interests of multiple local networks.

An intermediate layer that aggregates multicast interests into larger, more manageable groups significantly reduces the complexity and volume of routing information needed at the global level.

Regional Aggregation: Dedicated multicast routers or servers summarize the multicast group information from multiple local networks, reducing the granularity of information propagated globally.

Nodes subscribe to multicast groups relevant to their interests via MLDv2, which informs local routers of these interests. When transactions are broadcast or updates are sent, they are addressed to specific multicast groups based on transaction attributes such as version numbers and portions of transaction IDs.

Local Handling: Local routers manage multicast traffic within their networks based on MLDv2 reports.

Global Distribution: mBGP is used by ISPs to route traffic globally based on summarized interests from the aggregation layer.

Efficiency and Scalability: The aggregation/summarization layer updates mBGP information periodically, balancing the need for real-time accuracy with global routing efficiency.

To ensure the economic sustainability of this multicast architecture, a mechanism for out-of-band payments must be implemented alongside these lower-level routing protocols, allowing nodes to compensate network providers for the data they consume. This payment mechanism should be designed to prevent DoS attacks by making it costly to spam the network with unnecessary subscriptions. MLDv2 subscriptions or mBGP advertisements made without respect to an associated payment must be ignored and dropped.

Payment Integration: Implement a secure, blockchain-based payment system for subscription services to ensure that providers of network resources are compensated for their services. This is an area of future work.

Security Measures: Implement robust security measures to authenticate and authorize multicast subscriptions to prevent unauthorized and costly subscriptions that have not been paid for.

Monitoring and Management: Deploy real-time monitoring tools to manage multicast traffic flows and performance across all layers of the network.

Further research is needed to refine the aggregation algorithms and to enhance the scalability of the mBGP routing updates. Additionally, exploring the integration of an out-of-band payment mechanism for these multicast communications at scale will be crucial.

The proposed protocol provides a comprehensive solution for the scalable and efficient distribution of blockchain transaction data across global networks using IPv6 multicast. By leveraging MLDv2 at the edges for dynamic subscription management, mBGP at the core for robust global routing, and an aggregation/summarization layer in between, this protocol addresses the unique challenges posed by the high data volumes and rapid dynamics of modern blockchain networks.

This document serves as a foundational step towards implementing a robust multicast protocol tailored for blockchain applications, ensuring efficient data dissemination and economic viability.

BRC-431 defines an open-ended way to create protocols and systems of interaction within a BRC-422 key derivation architecture. However, client software implementing the BRC-431 invoice numbering scheme needs a way to manage its own internal state, encrypt data and perform administrative tasks like permissions management without interference from applications.

With this specification, we define a list of namespaces in which applications are never allowed to derive keys, and any client that follows this specification will refuse requests made by applications to perform these operations.

We reserve the following protocol IDs for the administrative and internal use of clients, no matter the security level:

Any protocol ID that starts with admin

label

The label to filter the transactions by.

skip

The number of transactions to skip before returning results (optional).

limit

The maximum number of transactions to return (optional).

Applications need the ability to remove specific outputs from a basket when they are no longer needed, without having to spend them. Furthermore, certificates may need to be deleted when they expire or are no longer relevant. This functionality allows for tokens and certificates to be managed more efficiently within a wallet, improving user experience and reducing clutter.

This BRC introduces two new message types to the BRC-56 messaging layer:

The Output Basket Removal Request message is sent by an application to request the removal of a specific output from a basket. It contains the following fields:

txid

The transaction ID of the output to be removed.

vout

The output index of the output to be removed.

basket

The name of the basket from which the output will be removed.

The wallet will validate the request and remove the requested output from the specified basket if it exists. If the requested output does not exist or the user denies permission, the wallet will respond with an error.

The Output Basket Removal Response message is sent by the wallet in response to an Output Basket Removal Request. If the removal was successful, the response will contain a success message. Otherwise, if the request was denied or the output could not be found, an error message will be included.

If the wallet is unable to fulfill the Output Basket Removal Request for any reason, it will respond with a JSON-formatted Output Basket Removal Error. The fields for the error message are as follows:

status

This should always be the string "error".

code

A machine-readable error code.

description

A human-readable description of the error.

One example of an Output Basket Removal Error is as follows:

The Certificate Deletion Request message is sent by an application to request the deletion of a specific digital certificate. It contains the following fields:

certifier

The certifier responsible for the certificate.

serialNumber

The serial number of the certificate.

certificateType

The type of the certificate to be deleted.

The wallet will validate the request and delete the specified certificate if it exists. If the certificate does not exist or the user denies permission, the wallet will respond with an error.

The Certificate Deletion Response message is sent by the wallet in response to a Certificate Deletion Request. If the deletion was successful, the response will contain a success message. Otherwise, if the request was denied or the certificate could not be found, an error message will be included.

If the wallet is unable to fulfill the Certificate Deletion Request for any reason, it will respond with a JSON-formatted Certificate Deletion Error. The fields for the error message are as follows:

status

This should always be the string "error".

code

A machine-readable error code.

description

A human-readable description of the error.

One example of a Certificate Deletion Error is as follows:

Implementations of this specification will need to extend the existing implementation of BRC-56 to include the functionality for output basket removal and certificate deletion. The wallet will need to handle incoming request messages, validate them, and perform the specified operations. The application will need to handle the response and error messages accordingly.

The use of scripts in Bitcoin SV transactions allows for greater flexibility and customization of transaction rules. To properly utilize these scripts, it is important to understand the different formats they can be written in. This standard aims to provide a clear and detailed description of the binary, hexadecimal, and ASM formats used in BSV scripts to facilitate their use in BSV transactions.

We specify three commonly-used Bitcoin script formats as follows:

The binary format is a series of bytes that represent the script. Each opcode in the script is represented by a single byte, with any arguments or data being represented by subsequent bytes. The script is executed sequentially, with each opcode performing a specific action on the stack. Bitcoin script uses reverse polish notation.

The hexadecimal format is a string of hexadecimal digits that represents the binary script. Each byte in the script is represented by two hexadecimal digits. The following is an example of a script in hexadecimal format:

Not to be confused with the full BRC-15 Assembly Language.

The ASM format is a human-readable format that represents the script in a more intuitive way. Each opcode and its arguments are represented by a single string. For example, the following script in ASM format checks that a given public key has signed the transaction:

The SASM format is a shortening of the above ASM format which uses lowercase and removes the OP_ prefix from op codes to aid in quick typing and clearer readability. For example, the above ASM script is repeated now in SASM:

BSV scripts can be written in any of the above formats and included in a transaction as a locking script or an unlocking script. To create a script in binary format, the opcodes can be written in hexadecimal and then converted to binary. To create a script in hexadecimal format, the binary script can be converted to hexadecimal. To create a script in the ASM format, the opcodes and arguments can be written as a string in the appropriate format.

There are various libraries and tools available for creating and working with BSV scripts in these formats, such as the bitcoin-cli command-line tool for the node software. These tools allow for the creation and manipulation of BSV scripts in any of the supported formats.

Bare multi-sig transactions offer a simple and straightforward method to enable multiple parties to authorize a transaction in a decentralized manner. This approach is particularly useful for securing funds, enhancing trust between parties, and enabling flexible access control. Although bare multi-sig transactions come with certain privacy trade-offs, their ease of implementation and direct use of low-level Bitcoin scripting constructs make them a valuable option in the Bitcoin SV ecosystem.

A bare multi-signature transaction output script adheres to the following structure:

minimum_signatures: The minimum number of signatures required to unlock the funds (also known as the "M" value).

pubkey1, pubkey2, ..., pubkeyn: The public keys involved in the multi-signature scheme.

maximum_signatures: The maximum number of public keys (also known as the "N" value).

OP_CHECKMULTISIG: The Bitcoin opcode that validates the provided signatures against the specified public keys.

The following example demonstrates a 2-of-3 multi-signature locking script:

Locking Script:

To spend the funds locked by this script, an unlocking script containing the required signatures must be provided:

In this example, the OP_0 opcode is required due to a known bug in the original implementation of the OP_CHECKMULTISIG opcode, which results in an extra item being consumed from the stack.

Bare multi-sig transactions work by requiring a minimum number of signatures from a given set of public keys to unlock the funds. When the locking script is executed, the OP_CHECKMULTISIG opcode verifies if the provided signatures correspond to the specified public keys and meet the minimum signature requirement. If the validation succeeds, the funds are unlocked and can be spent in a new transaction.

While bare multi-sig transactions offer simplicity in implementation, they also expose the public keys and the multi-signature scheme directly in the transaction output script, which may reveal information about the participants and their relationships. Despite these privacy concerns, bare multi-sig remains an important tool for creating secure and flexible transactions within the Bitcoin SV digital asset ecosystem.

Bitcoin is a token system, and as such, every output should be spendable and have value in satoshis. This fundamental principle ensures that Bitcoin remains a secure and reliable system that can be trusted by users around the world. However, traditional BRC-18 scripts, employing the OP_FALSE OP_RETURN pattern, are not compatible with this view.

OP_FALSE OP_RETURN outputs are non-spendable and carry no value, which means they cannot be considered tokens under this definition. This creates a problem for developers who want to store data on the blockchain using OP_RETURN, as it goes against the basic principles of the Bitcoin token system.

To address this issue, we propose a new methodology for creating OP_RETURN scripts that are spendable and contain satoshis. This provides a way for software to automatically convert non-compliant OP_RETURNs into proper Bitcoin tokens while encouraging developers to consider the spendability constraints that govern their tokens.

By adding the cost of one single satoshi and the fully-open spendability constraints to OP_RETURN outputs, developers will be encouraged to consider the actual constraints that govern their tokens. This will drive them towards script patterns that protect what their tokens represent and promote a more robust and secure token system for Bitcoin.

This standard offers a solution that maintains the fundamental principles of the Bitcoin token system while providing a practical way for developers to store data on the blockchain using OP_RETURN. By adopting this methodology, we can ensure that Bitcoin remains a secure and reliable system that can be trusted by users worldwide.

We specify the same script template as BRC-18, except that instead of OP_FALSE being the first opcode, it is replaced with OP_TRUE. We also stipulate that at least one satoshi must be locked in the output.

For example:

Because BRC-18 implementers did not define the constraints under which their Bitcoin tokens would be unlocked, we have defined a fully-open system in which anyone can redeem these tokens. If implementers see this as a problem, they should consider being cognisant of the mechanisms that define the spendability constraints of their Bitcoin outputs.

{

"inputs": {

"900b7e9ced44f8a7605bd4c1b7054b8fb958385998954d772820a8b81eabb56f": {

"rawTx": "010000000135620d3a8fb626b763cb7b9a3c3197eda9bd6709ef1e4ebc2b359607800eaa95020000006b483045022100c3ec1792f1780e453c6ea692271bcc5388fb179d6455897f4b4200706e8b9f150220352cc2ff81a5c698e4626aec8976643134efab91ca1c80729670c2d007c77cfd4121037798f038cb7fc18b9d67baa87ed33122eb7be65b95b0dd304dc476c60043773dffffffff03e803000000000000c4210399322f558d92ced9c45d3bfe7dc5c01b830a4b61d71695ab0a1fa2cd90aba8b9ac2131546f446f44744b7265457a6248594b466a6d6f42756475466d53585855475a473462812d4eeb030fa496c2965f7e0f0b0e825d0547aceb7a9d4c76fd17e795753d8e2e0e82274ab36744a7968a43dc45b1cbdfab6c473045022100a58914da5346960ecb4de964f0f1e1be43a7645a11449c3a209f3fd69b34209b02205d4d4294d04c5f87fb16c2cdc3d9b41f9866fb3d7a690da08089c972d1393d816d75c8000000000000001976a91473a95c0b12e33b3d79f80508200a075bbab0906588ac4ea80200000000001976a91478daf10df51b3ea4c9292a72bf2e1e1d48ebe11288ac00000000",

"proof": {

"index": 2,

"txOrId": "900b7e9ced44f8a7605bd4c1b7054b8fb958385998954d772820a8b81eabb56f",

"targetType": "header",

"target": "00000020ed40984238c0d6ed157cfd4fda4b284b48bb5c3b00b3172a2b030000000000006dfcabcc55b822548d10198ad1ddc62700947c8053213bf254b5229c92b9f448c6d32f64f13d051aa8201615",

"nodes": [

"9c97050e4c5fcc7f3ae7f7de83668d1968a626d70690654dab0398b75ca447a1",

"fde37bbbec5cb48c085749aea7059412cc59c339bbc3e98960c081632382d538"

]

},

"outputsToRedeem": [

{

"index": 0,

"unlockingScript": "473044022040ac4ef063c5139ef940860ec993dea2b38f2226cb841c231d60833d185934d50220760c48202fc150e3090ffbda4ccfe4ebce36715b4396d3555fb2f3dc03346e5cc2",

"spendingDescription": "Complete a ToDo list item"

}

]

}

},

"description": "Complete a TODO task: \\"test\\""

}{

"description": "Pay John Galt 3,301 satoshis",

"labels": ["payment", "personal"],

"outputs": [

{

"script": "76a914b10f7d6c7fda3285e9b98297428ed814374cbd4088ac",

"satoshis": 3301

}

]

}{

"label": "payment",

"limit": 10

}{

"transactions": [

{

"rawTx": "...",

"inputs": { ... },

"mapiResponses": { ... },

"txid": "..."

},

...

],

"totalActions": 42

}.lock

FALSE RETURN

<data1>

<data2>

<data3>{

"status": "error",

"code": "ERR_PERMISSION_DENIED",

"description": "The user has denied permission to remove this output from the basket."

}{

"status": "error",

"code": "ERR_CERTIFICATE_NOT_FOUND",

"description": "The specified certificate could not be found."

}<Buffer 76 a9 14 57 f5 0e 13 db 98 a8 8e 9e 1b 8f 03 f6 5a 80 9d 6e 9c 9c ba 88 ac>76a91457f50e13db98a88e9e1b8f03f65a809d6e9c9cba88acOP_DUP OP_HASH160 57f50e13db98a88e9e1b8f03f65a809d6e9c9cba OP_EQUALVERIFY OP_CHECKSIGdup hash160 57f50e13db98a88e9e1b8f03f65a809d6e9c9cba equalverify checksig<minimum_signatures> <pubkey1> <pubkey2> ... <pubkeyn> <maximum_signatures> OP_CHECKMULTISIG2 <pubkey1> <pubkey2> <pubkey3> 3 OP_CHECKMULTISIGOP_0 <signature1> <signature2>.lock

TRUE RETURN

<data1>

<data2>

<data3>An array serialized Bitcoin transactions

In practical use, BEEFs are exchanged between parties to build and process new transactions as well as validate arbitrary data recorded on the blockchain.

The extension proposed here is to allow for "agreed upon transactions" to be represented in the array of transactions as just their transaction hash (txid),

This avoids the need to include potentially significant amounts of data already known to the parties exchanging BEEFs.

In addition, this extension formally acknowledges that a BEEF may contain mulitple transaction "roots".

Consider when two parties cooperate over a short amount of time to construct one or more transactions.

Inputs may be added by either party. New inputs may come from unmined and mined transactions.

At each exchange of information along this process, one party sends a BEEF to the other to validate the new inputs or transaction(s) they originate.

The BEEF standard is well suited to this with two extensions:

In the general case, a BEEF does not need to be a single transaction tree.

A method of referencing what the process has previously validated.

For example, when adding new inputs to an incomplete transaction, the set of source transactions for these inputs may need to be transmitted to a second party. A BEEF of this validation information might include multiple trees of unmined transactions.

Furthermore, some of these inputs might be from transactions created earlier in the process for which complete validation data - back to mined transactions - has already been shared.

Consider in particular if some of these transactions are truly large or if the rate of linked transaction generation is high.

The serialized format for the transaction array is updated and the BEEF version number is incremented to 0200BEEF.

For each serialized transaction, the byte previously used to indicate BUMP (01) or no BUMP (00) is renamed the Tx Data Format, it is now the first thing written for each transaction, and the value of (02) is now used when only a 32 byte txid is serialized.

Version no

Version number starts at 4022206466, encoded Uint32LE => 0200BEEF

4 bytes

nBUMPs

VarInt number of BSV Unified Merkle Paths which follow

1-9 bytes

BUMP data

All of the BUMPs required to prove inclusion of inputs in longest chain of blocks

many bytes x nBUMPs

nTransactions

VarInt number of transactions which follow

1-9 bytes

A txid only transaction is treated as implicitly valid, no raw transaction or BUMP index is included and no BUMP data is required.

Additional transactions that consume outputs from a txid only transaction treat those inputs as fully validated.

The ordering of transactions obeys the V1 rules: Parents, including txid only, must occur before children.

The essential function of the BEEF format is to efficiently represent transaction validation data.

When multiple beefs are merged, all common BUMPS, merkle paths, and parent transactions are collapsed to a single copy.

Alice: Initiates the sync process.

Bob: Responds and participates in the sync process.

Initialization

Alice starts by sending a bloom filter containing all current spendable TXID+VOUTs as elements.

Receiving and Building List

Bob receives the filter and builds a list of his items that are not members of the set.

Transaction Verification

Bob sends an INV (Inventory) message to Alice for each item not in the set.

The INV includes:

Alice's Response

For each INV, Alice responds with a list of input transactions she does not know about.

If Alice has the transaction but the metadata hash differs, she requests updated metadata.

If Alice lacks the transaction, she requests the entire transaction.

Recursive Transaction Sync

Bob responds to Alice's requests with an INV containing the encompassing transaction, done recursively.

When including the full transaction, all metadata is provided.

Error Handling and Recovery

In case of errors, affected transactions are ignored and not synced.

If errors prevent a party from fully anchoring transactions back to the blockchain, these transactions are ignored.

Failures experienced by one party are not communicated to the other due to the declaratory nature of the protocol.

Finalization of Sync

The process continues until there are no more INVs for Bob to send.

Once complete, all of Bob's records are considered synced with Alice.

Role Reversal

The roles reverse, with Bob sending Alice a bloom filter.

The parties then exchange data in the other direction, following the same steps.

Verification of merkle proofs and the longest chain of block headers.

Recursively requesting information until all inputs are fully proven.

Invalidating transactions that cannot be linked back to a valid proof.

The protocol is adaptable to various blockchain environments.

The recursive nature ensures thorough and complete data synchronization.

The protocol emphasizes security, efficiency, and data integrity.

GASP offers a robust and secure method for synchronizing transaction data between parties in a blockchain network, leveraging recursive data exchange and thorough verification mechanisms.

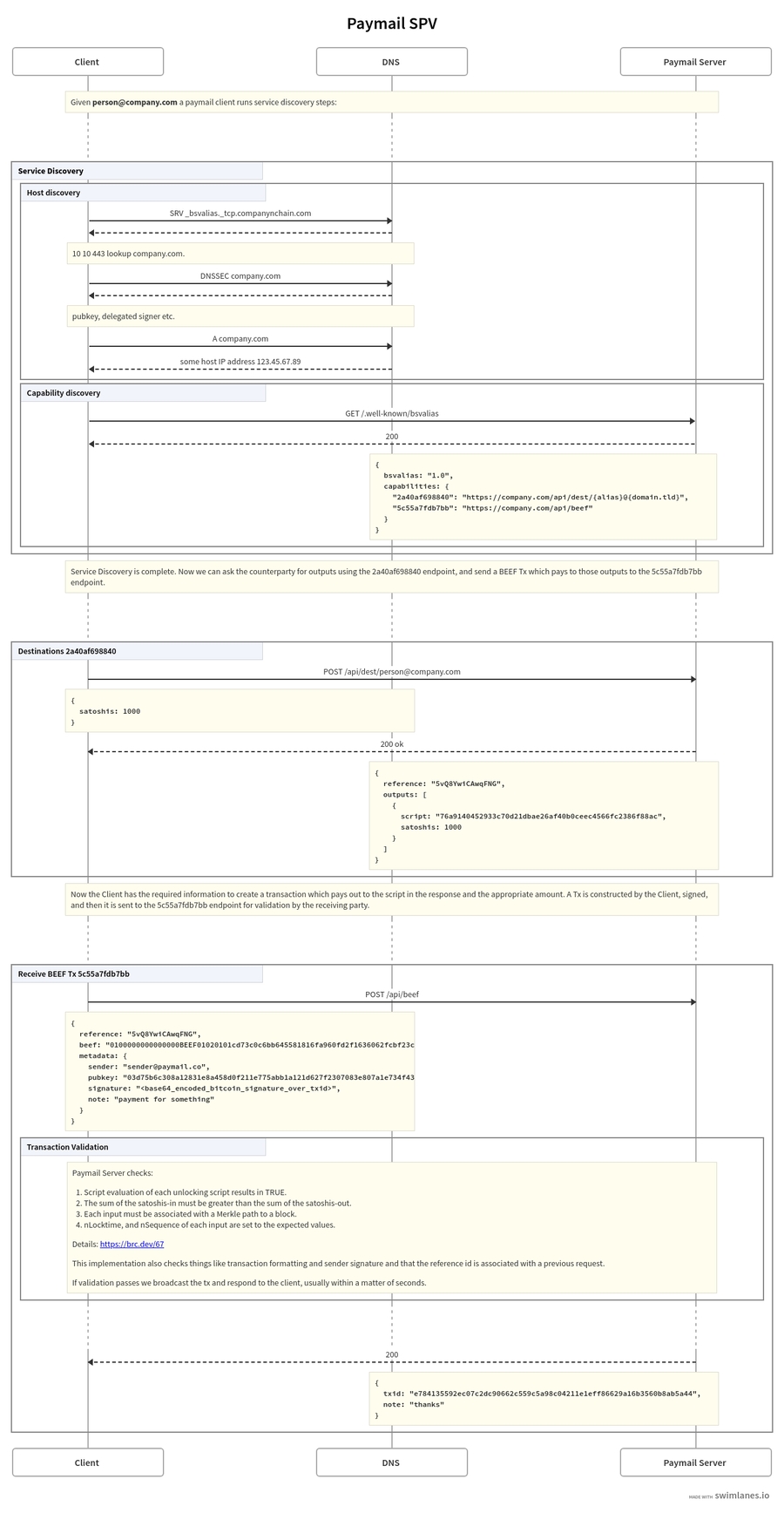

We propose that p2p destination and receive raw transaction functionality between hosts to include the data required for the counterparty to run SPV on the transaction.

A random ID was generated in order to avoid label collisions in the capability document of a paymail server.